Donation Methods

Auto Pay | Bank Account Donations (ACH/EFT) | Cash | Check | Bank Card | PayPal | Appreciatied Securities | IRAs/Qualified Charitable Distributions | Donor Advised Funds (DAF) | | Gifts of Grain, Livestock, and other Farming Assets | Other Possible Gift Avenues

Auto Pay:

Want to establish an automatic giving plan? You can use a credit or debit card, PayPal , or you can have gifts automatically debited from your checking or savings account. Periodic giving makes the process simple and allows you to support SGO scholarships without the worry of forgetting.

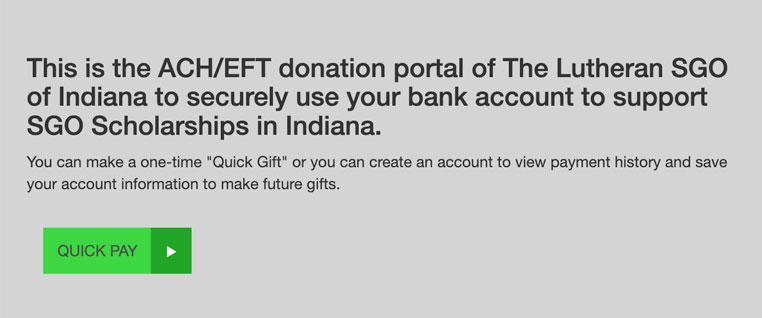

Bank Account Donations (ACH/EFT)

You can have gifts automatically debited from your checking or savings account. Rather than sending a check through the postal service and looking for envelopes and stamps, go to this site. You can make a one-time "Quick Gift" or create an account for autopay to make future gifts easier.

Cash Donation

Want to donate cash to fund SGO scholarships? Rather than sending cash through the mail system, we strongly recommend contacting us to arrange a time to deliver your gift in person at 260-203-4509 or donations@Lutheransgo.org. To submit the details of your gift electronically, complete the form below, or to print your details and send them to us with your cash gift via mail, complete and print this form.

Check Donation

Still the most common form of donation, checks and money orders can be sent to us at: PO Box 5174, Fort Wayne, Indiana, 46895. You can also contact us at 260-203-4509 or donations@Lutheransgo.org to arrange a time to deliver your gift in person. We recommend that you do not send your gift to the school to avoid any delays in processing your gift. You can complete the form below to submit the details of your gift or complete this form, print it and send it to us with your check via mail or email.

Online with Bank Card

A very popular way to support SGO scholarships, please visit this link to use a bank card and make a gift online. Questions? Contact us at 260-203-4509 or donations@Lutheransgo.org.

Online with PayPal

Some donors prefer the security and comfort of giving via their PayPal account. Click the PayPal link below to submit your gift via PayPal.

Questions? Contact us at 260-203-4509 or donations@Lutheransgo.org.

NOTE: As you fill out the PayPal donation form, please remember to specify the school name for your donation.

Gifts of Appreciated Securities

More and more donors are using stocks and mutual funds to fulfill their charitable goals. Donors may be able to avoid capital gains associated with selling securities by donating them to a nonprofit like The Lutheran SGO. You will need to provide your financial advisor or investment account processor with our unique DTC transfer information. Please contact us at 260-203-4509 or donations@Lutheransgo.org. We will also need you to complete this form, print it and send it to us via mail or email.

IRAs/Qualified Charitable Distributions

Donors who are 70 1/2 years old or older may transfer, tax-free, up to $100,000 per year from their qualified IRA account to a nonprofit like The Lutheran SGO. To initiate a gift of a Qualified Charitable Distribution (QCD, also known as a Charitable Rollover), you should instruct your IRA plan administrator to direct the distribution to "The Lutheran SGO" at our address. For their reference, our Tax ID # is 45-4856406. Please also complete the form below to submit our required information to capture your SGO tax credits. You may also complete this form, print it and send it to us via mail or email. Without this information we cannot capture your SGO credits. Contact us at 260-203-4509 or donations@LutheranSGO.org. And lastly, please download the IDOR form here.

Donor Advised Finds (DAF)

Donor Advised Funds, or DAFs, are a relative newcomer to the donation options, but is fast becoming a favorite with some donors. Contact us for a copy of the specificD To initiate a gift from your DAF, you should instruct your DAF plan administrator to direct the distribution to "The Lutheran SGO, Tax ID # 45-4856406" at our address. Please also complete the form below to submit our required information to capture your SGO tax credits. You may also complete this form, print it and send it to us via mail or email. Without this information we cannot capture your SGO credits. Contact us at 260-203-4509 or donations@LutheranSGO.org. And lastly, please download the IDOR form here.

Online with Crypto

We want to have options for everyone! If you would like to donate cryptocurrency, most types available can be donated through this link. Please also complete the form below to submit our required information to capture your SGO tax credits. You may also complete this form, print it and send it to us via mail or email. Without this information we cannot capture your SGO credits. Contact us at 260-203-4509 or donations@LutheranSGO.org.

Gifts of Grain, Livestock, and other Farming Assets

Farmers have their own unique set of tax-advantaged considerations, and we therefore have options for farmers to support SGO scholarships with their farming assets, including gifts of grain, corn, soybeans, etc. and livestock. You can view a recent presentation here. The form to complete and provide to the crop elevator or slaughterhouse is here. Contact us at 260-203-4509 or donations@LutheranSGO.org.

Other Gift Options

You may have another asset that you would like to donate to provide scholarships at a school in our family of schools. If the asset you would like us to consider has a readily-attainable value and can be sold in a reasonable timeframe, we would be willing to discuss the options. Contact us at 260-203-4509 or donations@LutheranSGO.org."

Helpful links

Mail-in Fillable Donation Form

LSGO Brochure

Donation FAQs

How to Claim your Tax Credits

(Provided by DWD CPA & Advisors. Please discuss this with your own financial and tax advisors.)